Sun Pharmaceutical Industries Ltd., incorporated in the year 1993, is a Large Cap company (having a market cap of Rs 4,16,212.64 Crore) operating in Pharmaceuticals sector.

Sun Pharmaceutical Industries Ltd. key Products/Revenue Segments include Pharmaceuticals and Other Operating Revenue for the year ending 31-Mar-2024.

For the quarter ended 31-12-2024, the company has reported a Consolidated Total Income of Rs 14,141.08 Crore, up 3.63 % from last quarter Total Income of Rs 13,645.39 Crore and up 11.96 % from last year same quarter Total Income of Rs 12,630.90 Crore. Company has reported net profit after tax of Rs 2,917.54 Crore in latest quarter.

The company’s top management includes Mr.Dilip S Shanghvi, Mr.Abhay Gandhi, Mr.S Damodharan, Dr.Uday Baldota, Mr.Aalok D Shanghvi, Mr.Sudhir V Valia, Mr.Gautam Doshi, Dr.Pawan Goenka, Mr.Rama Bijapurkar, Mr.Rolf Hoffmann, Mr.Sanjay Asher, Mr.C S Muralidharan, Mr.Anoop Deshpande. Company has S R B C & Co. LLP as its auditors. As on 31-12-2024, the company has a total of 239.93 Crore shares outstanding.

Sun Pharma Share Price Today is Rs. 1703.15. On previous day, the Sun Pharma Share Price (NSE) closed at Rs. 1731.45, featuring among the most traded securities on the National Stock Exchange.

Shareholdings:

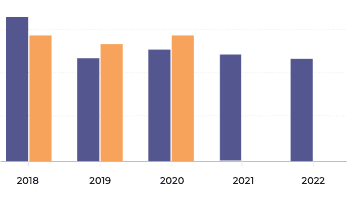

As of 31st Dec, 2024, the promoter held 54.48% of the stake in Sun Pharma shares, out of which 0.69% was pledged. On the same date, foreign institutional investors' (FII) holdings of Sun Pharma stocks was 18.04% as compared to 18.01% in Sep 2024 with increase of 0.03%. The domestic institutional investors (DII) holdings on 31st Dec, 2024 was 18.35% as compared to 18.42% in Sep 2024 with decrease of 0.07%. Out of the total DII holdings in Sun Pharma shares 12.24% was held by mutual funds. The rest including public held is 9.13%. Sun Pharma stock price is reflected on both the exchanges - BSE and NSE.

Dividend, Bonus & Split Information:

Sun Pharma Dividend: Ever since 1993, Sun Pharma dividends has been paid out around 39 times. As on 01 Apr, 2025, 10:48 AM IST, The overall dividend yield for Sun Pharma stands at 0.78%. The last dividend paid was on February 6, 2025 (Rs. 10.5). The Earnings Per Share (EPS) for quarter ending 31st Dec 2024 is Rs. 47.69.

Sun Pharma Bonus: The most recent bonus issue had been in year July 29, 2013 around 11 years ago at 1 : 1 ratio. The first bonus issue was announced in Feb 2000.

Stock Forecast:

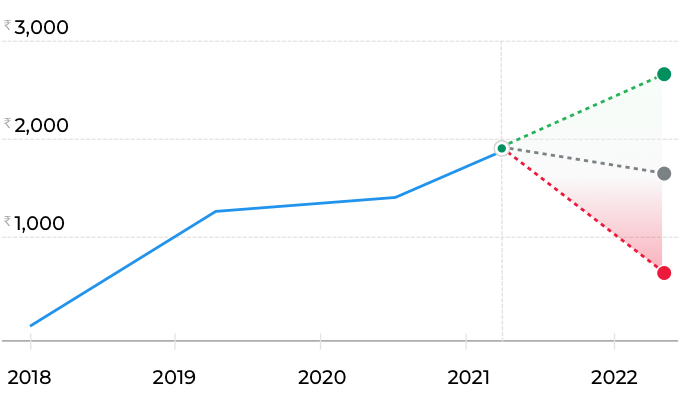

After showing 14379.6 Cr. of sales and 5.38% of quarterly net profit, there have been multiple ups and downs in the Sun Pharma stock prices in the past few weeks. For example, Sun Pharma stock price on 24th of March 2025 was around Rs. 1784.5. Sun Pharma share price now stands at an average of Rs. 1703.15. Judging by last week's performance, stock is in down trend.

Sun Pharma has a median target price of Rs. 2022.3 in 12 months by 33 analysts. They have provided a high estimate of Rs. 2450.0 and low estimate of Rs. 1475.0 for Sun Pharma share.

Historical Prices and Performance:

Sun Pharma, incorporated in 1993 is a Large Cap company (with a market cap of Rs. 416212.64) operating in Pharmaceuticals sector.

The Return of Equity (ROE) in last five financial years given by Sun Pharma stock was 15.04%, 15.13%, 6.81%, 6.24% and 8.31% respectively.

The Sun Pharma share gave a 3 year return of 88.69% as compared to Nifty 50 which gave a return of 35.75%.

Sun Pharma announced 1050.0% final dividend on February 6, 2025.

Key Metrics:

PE Ratio of Sun Pharma is 36.37

Prices/Sales Ratio of Sun Pharma is 8.02

Price/Book Ratio of Sun Pharma is 6.2

Peer Insights:

Peers are businesses with comparable activities, buisness objectives and affiliation with a particular industry area. For Sun Pharma, major competitors and peers include Divis Labs, Cipla, Torrent Pharma and Mankind Pharma. As of Sep 2024, the dividend yield of Sun Pharma stands at 0.78% while Divis Labs, Cipla, Torrent Pharma and Mankind Pharma stand at 0.52%, 0.9%, 0.87% and 0.0% respectively. The PE ratio and PB Ratio of the company are among its competitors stand at 36.37 and 6.2 respectively.

Recommendations:

The current total number of analysts covering the stock stands at 31, Three months ago this number stood at 33. Out of total, 13 analyst have a'Strong Buy' reco, 12 analyst have a'Buy' reco, 4 analyst have a'Hold' reco, 2 analyst have a'Sell' reco.

Mean recommendations by 31 analyst stand at'Buy'.

Leadership of Sun Pharma :

Anoop Deshpande is Co. Secretary & Compl. Officer

C S Muralidharan is Chief Financial Officer

Abhay Gandhi is CEO - North America

Uday Baldota is CEO - Taro Pharmaceutical Industries Ltd.

Kirti Ganorkar is Head

Azadar H Khan is Head

Hellen de Kloet is Business Head

Sreenivas Rao is Head

S Damodharan is CEO - API Business

Suresh Rai is Chief Human Resource Officer

Meeta Chatterjee is Chief Strategy Officer

Dheeraj Sinha is Chief Information Officer

Marek Honczarenko is Head

Sridhar Shankar is Head

Dilip S Shanghvi is Chairman & Managing Director

Aalok D Shanghvi is Whole Time Director

Sudhir V Valia is Non Exe.Non Ind.Director

Pawan Goenka is Lead Independent Director

Rama Bijapurkar is Independent Director

Gautam Doshi is Independent Director

Sanjay Asher is Independent Director

Rolf Hoffmann is Independent Director

Stocks to buy today: IndusInd Bank gets a downgrade; Motilal Oswal sees over 20% upside in Sun Pharma

Stocks to buy today: IndusInd Bank gets a downgrade; Motilal Oswal sees over 20% upside in Sun Pharma Stocks in news: M&M, Glenmark Pharma, Tata Motors, IOB, Sun Pharma

Stocks in news: M&M, Glenmark Pharma, Tata Motors, IOB, Sun Pharma Reciprocal tariffs may make Indian generic drugs costlier in US: Pharma giants on Trump stance

Reciprocal tariffs may make Indian generic drugs costlier in US: Pharma giants on Trump stance