Bullish signal on daily chart

Invest in the Best

Check two-year estimates on Price, Revenue & Earnings

| Open | 205.89 |

| High | 208.90 |

| Low | 204.11 |

| Prev Close | 206.46 |

| Volume | 66,70,814 |

| VWAP(?) | 206.85 |

Quarterly Topline Performance

Company witnessed QoQ revenue decline of 2.83%, which is lowest in the last 3 years. (Source: Consolidated Financials)Stock Returns vs Nifty Midcap 100

Stock gave a 3 year return of 81.54% as compared to Nifty Midcap 100 which gave a return of 71.88%. (as of last trading session)Beating 3 Yr Revenue CAGR

Company's annual revenue growth of 32.15% outperformed its 3 year CAGR of 11.73%. (Source: Consolidated Financials)Stock Returns vs Nifty Financial Services

Stock generated 81.54% return as compared to Nifty Financial Services which gave investors 44.31% return over 3 year time period. (as of last trading session)Manappuram Finance Share Price Update

Manappuram Finance Ltd. share price moved up by 0.82% from its previous close of Rs 206.46. Manappuram Finance Ltd. stock last traded price is 208.14

| Share Price | Value |

|---|---|

| Today/Current/Last | 208.14 |

| Previous Day | 206.46 |

Found Insights useful?

| 1 Day | 0.82% |

| 1 Month | 7.26% |

| 3 Months | 14.32% |

| 1 Year | 29.84% |

| 3 Years | 78.13% |

| 5 Years | 55.04% |

| PE Ratio(x) | 8.95 |

| EPS - TTM(?) | 23.26 |

| MCap(? Cr.) | 17,614.31 |

| MCap Rank | 24 |

| PB Ratio(x) | 1.51 |

| Div Yield(%) | 1.59 |

| Face Value(?) | 2.00 |

| 52W High(?) | 230.40 |

| 52W Low(?) | 138.35 |

| MCap/Sales | 1.66 |

| Beta(1 Month) | 2.71 |

| BV/Share(?) | 136.77 |

14 Analysts

| Ratings | Current | 1W Ago | 1M Ago | 3M Ago |

|---|---|---|---|---|

| Strong Buy | 2 | 2 | 3 | 4 |

| Buy | 4 | 4 | 3 | 3 |

| Hold | 6 | 6 | 6 | 6 |

| Sell | 2 | 2 | 1 | 1 |

| Strong Sell | - | - | - | - |

| # Analysts | 14 | 14 | 13 | 14 |

Stocks in news: ONGC, NTPC, SBI Life, Manappuram Finance, Biocon

Stocks in news: ONGC, NTPC, SBI Life, Manappuram Finance, Biocon

Two Trades for Today: A realty major for over 4% gain; a large-cap NBFC stock for almost 5% rise

Two Trades for Today: A realty major for over 4% gain; a large-cap NBFC stock for almost 5% rise

Manappuram Finance shares fall 8% after Q3 results

Manappuram Finance shares fall 8% after Q3 results

Announcement under Regulation 30 (LODR)-Award_of_Order_Receipt_of_Order

Announcements| Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | |

|---|---|---|---|---|---|

| Total Income | 2,562.63 | 2,637.14 | 2,511.93 | 2,362.22 | 2,326.68 |

| Total Income Growth (%) | -2.83 | 4.98 | 6.34 | 1.53 | 7.02 |

| Total Expenses | 1,261.23 | 958.77 | 910.83 | 837.53 | 791.55 |

| Total Expenses Growth (%) | 31.55 | 5.26 | 8.75 | 5.81 | 7.27 |

| EBIT | 1,301.40 | 1,678.37 | 1,601.10 | 1,524.69 | 1,535.13 |

| EBIT Growth (%) | -22.46 | 4.83 | 5.01 | -0.68 | 6.89 |

| Profit after Tax (PAT) | 282.06 | 570.65 | 554.62 | 561.53 | 572.87 |

| PAT Growth (%) | -50.57 | 2.89 | -1.23 | -1.98 | 2.60 |

| EBIT Margin (%) | 50.78 | 63.64 | 63.74 | 64.54 | 65.98 |

| Net Profit Margin (%) | 11.01 | 21.64 | 22.08 | 23.77 | 24.62 |

| Basic EPS (?) | 3.29 | 6.75 | 6.58 | 6.66 | 6.79 |

All figures in Rs Cr, unless mentioned otherwise

Quarterly Topline Performance

Company witnessed QoQ revenue decline of 2.83%, which is lowest in the last 3 years. (Source: Consolidated Financials)Beating 3 Yr Revenue CAGR

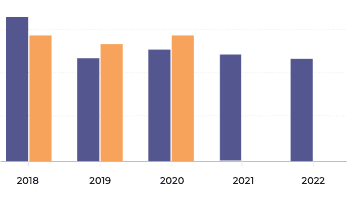

Company's annual revenue growth of 32.15% outperformed its 3 year CAGR of 11.73%. (Source: Consolidated Financials)| Annual | FY 2024 | FY 2023 | FY 2022 | FY 2021 | FY 2020 |

|---|---|---|---|---|---|

| Total Assets | 46,747.90 | 39,504.13 | 33,810.55 | 31,337.78 | 28,951.15 |

| Total Assets Growth (%) | 18.34 | 16.84 | 7.89 | 8.24 | 41.60 |

| Total Liabilities | 35,170.92 | 29,838.91 | 25,426.10 | 23,983.15 | 23,146.76 |

| Total Liabilities Growth (%) | 17.87 | 17.36 | 6.02 | 3.61 | 46.01 |

| Total Equity | 11,576.98 | 9,665.22 | 8,384.46 | 7,354.64 | 5,804.39 |

| Total Equity Growth (%) | 19.78 | 15.28 | 14.00 | 26.71 | 26.39 |

| Current Ratio (x) | 1.30 | 1.66 | 2.08 | 2.45 | 1.90 |

| Total Debt to Equity (x) | 2.91 | 2.95 | 2.88 | 3.11 | 3.82 |

| Contingent Liabilities | 637.32 | 473.17 | 91.35 | 553.60 | 395.90 |

All figures in Rs Cr, unless mentioned otherwise

| Annual | FY 2024 | FY 2023 | FY 2022 | FY 2021 | FY 2020 |

|---|---|---|---|---|---|

| Net Cash flow from Operating Activities | -3,382.68 | -3,103.24 | -423.08 | -619.35 | -3,625.29 |

| Net Cash used in Investing Activities | -592.66 | -616.16 | -192.62 | -186.48 | 26.12 |

| Net Cash flow from Financing Activities | 4,024.73 | 3,849.11 | 438.25 | 58.52 | 6,051.87 |

| Net Cash Flow | 49.39 | 129.71 | -177.44 | -747.31 | 2,452.70 |

| Closing Cash & Cash Equivalent | 2,549.87 | 2,500.48 | 2,370.77 | 2,548.21 | 3,293.08 |

| Closing Cash & Cash Equivalent Growth (%) | 1.98 | 5.47 | -6.96 | -22.62 | 291.86 |

| Total Debt/ CFO (x) | -9.95 | -9.18 | -57.01 | -36.68 | -6.02 |

All figures in Rs Cr, unless mentioned otherwise

Decrease in Cash from Investing

Company has used Rs 592.66 cr for investing activities which is an YoY decrease of 3.81%. (Source: Consolidated Financials)| Annual | FY 2024 | FY 2023 | FY 2022 | FY 2021 | FY 2020 |

|---|---|---|---|---|---|

| Return on Equity (%) | 18.95 | 15.51 | 15.87 | 23.59 | 25.68 |

| Return on Capital Employed (%) | 49.09 | 25.53 | 20.83 | 23.83 | 26.90 |

| Return on Assets (%) | 4.68 | 3.78 | 3.92 | 5.50 | 5.06 |

| Interest Coverage Ratio (x) | 2.12 | 2.03 | 1.99 | 2.04 | 2.10 |

| Asset Turnover Ratio (x) | 0.21 | 0.18 | 0.16 | 20.20 | 18.87 |

| Price to Earnings (x) | 6.69 | 7.00 | 7.24 | 7.33 | 5.46 |

| Price to Book (x) | 1.27 | 1.09 | 1.15 | 1.73 | 1.40 |

| EV/EBITDA (x) | 7.44 | 8.11 | 7.78 | 6.90 | 6.55 |

| EBITDA Margin (%) | 68.62 | 66.31 | 65.87 | 74.33 | 73.25 |

Found Financials useful?

5 Day EMA Crossover

Bullish signal on daily chart

Appeared on: 12 Mar 2025

5D EMA: 204.52

Average price gain of 4.14% within 7 days of Bullish signal in last 5 years

10 Day EMA Crossover

Bullish signal on daily chart

Appeared on: 12 Mar 2025

10D EMA: 203.52

Average price gain of 4.39% within 7 days of Bullish signal in last 5 years

14 Day EMA Crossover

Bullish signal on daily chart

Appeared on: 12 Mar 2025

14D EMA: 202.74

Average price gain of 4.71% within 7 days of Bullish signal in last 5 years

MACD Crossover

Bearish signal on daily chart

Appeared on: 11 Mar 2025

Region: Positive

Average price decline of -5.37% within 10 days of Bearish signal in last 10 years

Stochastic Crossover

Bullish signal on weekly chart

Appeared on: 7 Mar 2025

Region: Overbought (Above 80)

Average price gain of 10.40% within 7 weeks of Bullish signal in last 10 years

Global Meltdown1st Jan 2008 to 10th Nov 2008

Covid Crisis1st Feb 2020 to 31st Mar 2020

| R1 | 209.99 | Pivot 207.05 | S1 | 205.20 |

| R2 | 211.84 | S2 | 202.26 | |

| R3 | 216.63 | S3 | 197.47 |

| 5 Days | 14 Days | 28 Days |

| 7.24 | 8.38 | 8.42 |

Found Technicals useful?

Choose from Peers

Choose from Stocks

Stock Returns vs Nifty Midcap 100

Stock gave a 3 year return of 81.54% as compared to Nifty Midcap 100 which gave a return of 71.88%. (as of last trading session)Stock Returns vs Nifty Financial Services

Stock generated 81.54% return as compared to Nifty Financial Services which gave investors 44.31% return over 3 year time period. (as of last trading session)Found Peer Comparison useful?

MF Ownership as on 31 January 2025

154.08

Amount Invested (in Cr.)

1.03%

% of AUM

0.00

% Change (MoM basis)

96.73

Amount Invested (in Cr.)

1.05%

% of AUM

-13.29

% Change (MoM basis)

95.62

Amount Invested (in Cr.)

0.17%

% of AUM

-0.06

% Change (MoM basis)

| Date | Price | Open Interest |

|---|---|---|

27-03-2025Current | 5.40- (0.00%) | 24,87,0000 (0.00%) |

0.00 Open | 0.00 High | 0.00 Low |

5.40 Close | 0 Contracts Traded | 0.00 Turnover (? Lakhs) |

Open Interest as of 13 Mar 2025

| Date | Price | Open Interest |

|---|---|---|

27-03-2025Current | 209.022.13 (1.03%) | 6,23,82,000-921,000 (-1.45%) |

206.45 Open | 209.80 High | 206.45 Low |

206.89 Prev Close | 307 Contracts Traded | 1,915.27 Turnover (? Lakhs) |

Open Interest as of 13 Mar 2025

Interim Dividend

50%

Feb 13, 2025

Board Meeting

Quarterly Results & Interim Dividend

Feb 10, 2025

Interim Dividend

50%

Nov 05, 2024

| Announced on | Meeting on |

| Feb 10, 2025 | Feb 13, 2025 |

| Quarterly Results & Interim Dividend | |

| Oct 17, 2024 | Nov 05, 2024 |

| Quarterly Results & Interim Dividend | |

| Jul 26, 2024 | Aug 13, 2024 |

| Quarterly Results & Interim Dividend | |

| May 07, 2024 | May 24, 2024 |

| Audited Results & Interim Dividend | |

| Mar 12, 2024 | Mar 19, 2024 |

| Others | |

| Announced on | Ex-Date | Dividend% |

| Feb 13, 2025 | Feb 21, 2025 | 50% |

| Nov 05, 2024 | Nov 18, 2024 | 50% |

| Aug 14, 2024 | Aug 26, 2024 | 50% |

| May 24, 2024 | Jun 05, 2024 | 50% |

| Feb 07, 2024 | Feb 16, 2024 | 45% |

| Announced on | Ex-Date |

| Apr 28, 2011 | Jun 09, 2011 |

| Bonus Ratio: 1 share(s) for every 1 shares held | |

| Mar 18, 2010 | May 03, 2010 |

| Bonus Ratio: 1 share(s) for every 1 shares held | |

| Jan 15, 2007 | Mar 14, 2007 |

| Bonus Ratio: 1 share(s) for every 1 shares held | |

| Announced on | Ex-Date |

| Mar 18, 2010 | May 03, 2010 |

| Split: Old FV10.0| New FV:2.0 | |

| Announced on | Ex-Date |

| Nov 20, 2002 | Jun 04, 2003 |

| NA | |

| Announced on | Meeting on |

| Jul 22, 2024 | Aug 14, 2024 |

| - | |

| Mar 13, 2024 | Apr 05, 2024 |

| - | |

| Nov 28, 2023 | Dec 30, 2023 |

| - | |

| Jun 20, 2023 | Aug 17, 2023 |

| - | |

| Jan 05, 2023 | Feb 07, 2023 |

| - | |

Manappuram Finance Ltd., incorporated in the year 1992, is a Mid Cap company (having a market cap of Rs 17,617.69 Crore) operating in NBFC sector.

Industry

Key Indices Listed On

Nifty Smallcap 100, Nifty 500, BSE 500, Nifty Dividend Opportunities 50, BSE 250 SmallCap Index

Address

W-4/638 A, Manappuram House,Valapad P.O,Thrissur, Kerala - 680567

Shailesh Jayantilal Mehta

Chairman(NonExe.&Ind.Director)V P Nandakumar

Managing Director & CEOSumitha Nandan

Executive DirectorAbhijit Sen

Ind. Non-Executive DirectorDATA SOURCES: TickerPlant (for live BSE/NSE quotes service) and Dion Global Solutions Ltd. (for corporate data, historical price & volume, F&O data). Sensex & BSE Quotes and Nifty & NSE Quotes are real-time and licensed from BSE and NSE respectively. All timestamps are reflected in IST (Indian Standard Time).

DISCLAIMER: Any and all content on this website including tools/analysis is provided to you only for convenience and on an “as-is, as- available” basis without representation and warranties of any kind. The content and any output of such tools/analysis is for informational purposes only and should not be relied upon or construed as an investment advice or guarantee for any specific performance/returns advice or considered as recommendation for the purchase or sale of any security or investment. You are advised to exercise caution, discretion and independent judgment with regards to the same and seek advice from professionals and certified experts before taking any decisions.

By using this site, you agree to the Terms of Service and Privacy Policy.