HRA Calculator: How to calculate HRA tax exemption

Calculation of tax-exempt HRA amount

The amount of HRA received by you from your employer is not fully exempt from tax. The tax-exempt portion of the HRA is actually the minimum of the following:

a) Actual HRA received from employer

b) 50 percent of the 'salary' if the accommodation is in the metro cities (Delhi, Mumbai, Chennai, Kolkata) or else 40 percent for other cities

c) Excess rent paid annually over 10 percent of the annual 'salary'

Here 'salary' means basic salary, dearness allowance (DA) (if it forms part of the retirement benefit) and commission received on the basis of percentage of turnover. No other allowances like special allowance are added into to your salary for computing the tax-exempted HRA amount.

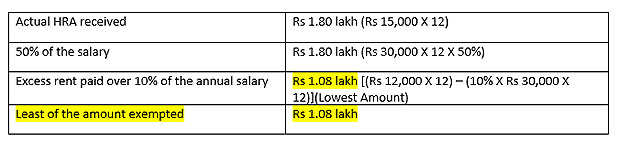

Let us assume that you live in Delhi and pay a monthly rent of Rs 12,000. Your basic salary is Rs 30,000 per month and you get a monthly HRA of Rs 15,000. The tax exempted HRA amount will be the lowest of the following:

The lowest amount is mentioned above is Rs 1.08 lakh which will be exempted from the tax. Rest of the amount received will be taxable. Therefore, Rs 72,000 (Rs 1.80 lakh minus Rs 1.08 lakh) will be taxed according to your income slab.

How to claim the benefit

To avoid excess TDS from being deducted from your salary, you will have to provide rent agreement and/or rent receipts to your employer. If your annual rent payment is more than Rs 1 lakh, then you will provide your landlord's PAN, as well, to your employer.

However, even if you have forgotten to submit rent receipts/rent agreement to your employer, then you can claim the benefit at the time of filing of income tax returns. It is advisable to keep proofs of rent paid and rent receipts as the tax department can ask you to provide it to authenticate your claim.

Special cases to claim HRA benefit

- Rent paid to your parents

- Own a house but staying in a different city

- When can you not claim HRA exemption