Company has spent 3.28% of its operating revenues towards interest expenses and 10.69% towards employee cost in the year ending Mar 31, 2024. (Source: Consolidated Financials)

Tata Steel Share Price

Tata Steel share price insights

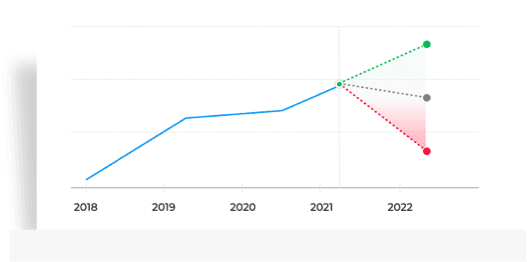

Stock gave a 3 year return of 21.68% as compared to Nifty 100 which gave a return of 33.33%. (as of last trading session)

Stock generated 21.68% return as compared to Nifty Metal which gave investors 46.08% return over 3 year time period. (as of last trading session)

Tata Steel Ltd. share price moved up by 0.29% from its previous close of Rs 158.60. Tata Steel Ltd. stock last traded price is 159.05

Share Price Value Today/Current/Last 159.05 Previous Day 158.60

Key Metrics

PE Ratio (x) | 72.72 | ||||||||||

EPS - TTM (?) | 2.19 | ||||||||||

MCap (? Cr.) | 1,97,951 | ||||||||||

Sectoral MCap Rank | 2 | ||||||||||

PB Ratio (x) | 2.14 | ||||||||||

Div Yield (%) | 2.26 | ||||||||||

Face Value (?) | 1.00 | ||||||||||

Beta Beta

| 1.55 | ||||||||||

VWAP (?) | 158.35 | ||||||||||

52W H/L (?) |

Tata Steel Share Price Returns

| 1 Day | 0.3% |

| 1 Week | 5.43% |

| 1 Month | 15.23% |

| 3 Months | 13.07% |

| 1 Year | 9.21% |

| 3 Years | 22.04% |

| 5 Years | 434.24% |

Tata Steel News & Analysis

Tata Steel Share Recommendations

Recent Recos

Current

Mean Recos by 31 Analysts

SellSellHoldBuyStrong

Buy

- Target₹167

- OrganizationICICI Securities

- BUY

- Target₹197

- OrganizationAxis Securities

- BUY

Analyst Trends

| Ratings | Current | 1 Week Ago | 1 Month Ago | 3 Months Ago |

|---|---|---|---|---|

| Strong Buy | 10 | 9 | 9 | 6 |

| Buy | 9 | 9 | 9 | 9 |

| Hold | 7 | 7 | 7 | 8 |

| Sell | 1 | 1 | 1 | 1 |

| Strong Sell | 4 | 4 | 4 | 6 |

| # Analysts | 31 | 30 | 30 | 30 |

Tata Steel Financials

Insights

Employee & Interest Expense

Company has spent 3.28% of its operating revenues towards interest expenses and 10.69% towards employee cost in the year ending Mar 31, 2024. (Source: Consolidated Financials)

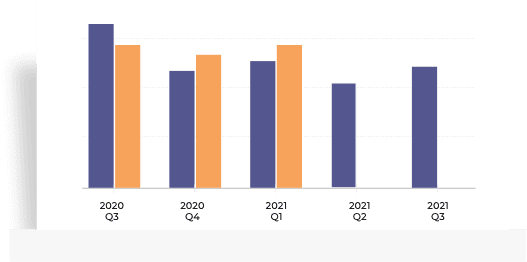

Quarterly | Annual Dec 2024 Sep 2024 Jun 2024 Mar 2024 Dec 2023 Total Income 53,869.33 54,503.30 55,031.30 58,863.22 55,539.77 Total Income Growth (%) -1.16 -0.96 -6.51 5.98 -0.66 Total Expenses 50,440.19 50,342.09 50,970.28 55,249.10 51,804.48 Total Expenses Growth (%) 0.19 -1.23 -7.74 6.65 -14.79 EBIT 3,429.14 4,161.21 4,061.02 3,614.12 3,735.29 EBIT Growth (%) -17.59 2.47 12.37 -3.24 - Profit after Tax (PAT) 326.64 833.45 959.61 611.48 513.37 PAT Growth (%) -60.81 -13.15 56.93 19.11 - EBIT Margin (%) 6.37 7.63 7.38 6.14 6.73 Net Profit Margin (%) 0.61 1.53 1.74 1.04 0.92 Basic EPS (?) 0.26 0.67 0.77 0.49 0.42 All figures in Rs Cr, unless mentioned otherwise

Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 Total Assets 2,73,423.50 2,88,021.74 2,85,445.60 2,45,487.21 2,50,419.45 Total Assets Growth (%) -5.07 0.90 16.28 -1.97 7.21 Total Liabilities 1,80,990.76 1,82,846.53 1,68,347.14 1,67,978.76 1,74,256.55 Total Liabilities Growth (%) -1.01 8.61 0.22 -3.60 7.37 Total Equity 92,432.74 1,05,175.21 1,17,098.46 76,733.45 73,887.90 Total Equity Growth (%) -12.12 -10.18 52.60 3.85 7.06 Current Ratio (x) 0.72 0.89 1.02 0.85 0.95 Total Debt to Equity (x) 0.89 0.76 0.60 1.10 1.59 Contingent Liabilities 46,125.93 34,871.14 33,004.72 25,723.75 26,907.88 All figures in Rs Cr, unless mentioned otherwise

Insights

Decrease in Cash from Investing

Company has used Rs 14251.44 cr for investing activities which is an YoY decrease of 23.71%. (Source: Consolidated Financials)

Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 Net Cash flow from Operating Activities 20,300.67 21,683.08 44,380.99 44,326.68 20,168.72 Net Cash used in Investing Activities -14,251.44 -18,679.84 -10,881.23 -9,322.88 -14,530.35 Net Cash flow from Financing Activities -11,096.99 -6,980.69 -23,401.09 -37,089.67 -1,694.62 Net Cash Flow -5,049.06 -3,477.06 10,074.88 -2,200.26 4,462.04 Closing Cash & Cash Equivalent 7,080.84 12,129.90 15,606.96 5,532.08 7,732.34 Closing Cash & Cash Equivalent Growth (%) -41.62 -22.28 182.12 -28.46 159.86 Total Debt/ CFO (x) 4.02 3.60 1.55 1.82 5.62 All figures in Rs Cr, unless mentioned otherwise

Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 Return on Equity (%) -4.82 8.49 35.08 10.19 2.18 Return on Capital Employed (%) 8.13 12.58 28.31 12.69 5.79 Return on Assets (%) -1.62 3.04 14.06 3.05 0.62 Interest Coverage Ratio (x) 3.21 5.29 11.77 4.13 1.44 Asset Turnover Ratio (x) 0.82 0.85 0.92 0.63 59.48 Price to Earnings (x) -43.86 14.58 3.98 12.99 19.88 Price to Book (x) 2.11 1.24 1.39 1.32 0.43 EV/EBITDA (x) 11.10 5.83 3.35 5.59 7.06 EBITDA Margin (%) 10.52 13.69 26.34 20.06 13.19 MANAGEMENT DISCUSSION AND ANALYSIS (FY 20-21)

Gross debt and Net debt

Net debt was lower by Rs 29,390 crore over previous year. Gross Debt at ?88,501 crore was lower by Rs 27,827 crore as compared to the previous year. Decrease in Gross Debt was mainly due to repayment / pre-payment of borrowings including lease liabilities. These decreases were partly offset by addition to leases (mainly at TSE) along with higher amortisation of loan issue expenses, primarily due to pre-payments and increase due to re-classification of SEA operations into continuing operations from held for sale. The decrease in Net Debt was in line with decrease in gross debt along with increase in current investments mainly at Tata Steel (Standalone) and at TSBSL, partly offset by decrease in cash and bank balances mainly at Tata Steel Global Holdings.

Fiscal stimulus and outlook

Steel demand is expected to be strong due to recovery in manufacturing businesses around the world and global fiscal stimulus supporting infrastructure projects. The outlook for 2021 is expected to be positive because of the unprecedented fiscal stimulus provided by the governments across Europe, the US, Japan, Korea, Russia and China. These stimulus packages are expected to spur growth in these nation?s respective infrastructure sectors, boosting steel demand. China is expected to grow by 5% in 2021 with continuation of healthy demand conditions especially in the first half of 2021. Steel demand in key emerging economies (like India, Turkey) and Europe is expected to witness double digit recovery while Asia and Middle-East are likely to grow by 5%. While it is expected that steel prices will consolidate closer to historical levels, prices are likely to remain high supported by (i) strong iron ore prices, (ii) rebound in coking coal prices, (iii) positive impact from stimulus plans, and (iv) improved business confidence from the roll-out of vaccines. Strong rebound of demand in 2021, in addition to supply-side reforms in China could lead to higher steel prices globally.

Lower demand, but higher realizations.

The turnover of TSG was at ?1,56,294 crore during FY 2020-21, an increase of 5% over the previous financial year due to increase in realisations across geographies, partly offset by marginal decline in deliveries. The EBITDA of TSG was ?30,892 crore during the FY 2020-21 as compared to ?18,103 crore in the previous year due to improvement in realisations along with lower cost and favourable exchange rate movement at other foreign entities. The impact of COVID-19 has been much more benign for the steel industry due to resurgent demand in China and better than expected post lockdown recovery globally in second half of 2020. China and Turkey were two key countries that saw an increase in finished steel demand of 9% and 13% respectively in 2020. North America and the European Union (?EU?) have experienced strong decline in steel demand owing to the COVID-19 pandemic. Both regions experienced demand decline of around 11%-16%. India also contributed to global decline, as steel consumption in India declined by 13.7% to 88.5 MnT in 2020 against 102.6 MnT in 2019.

Tata Steel Technicals

Stock doesn't have any Buy/Sell Signals.

- 46%Positive Movement since

1st Jan 2005 on basis53%Negative Movement since

1st Jan 2005 on basisExclude Pivot Levels

R1 R2 R3 PIVOT S1 S2 S3 Classic 159.70 160.80 163.50 158.10 157.00 155.40 152.70 Average True Range

5 DAYS 14 DAYS 28 DAYS ATR 3.80 4.04 3.95

Tata Steel Peer Comparison

Insights

Stock Returns vs Nifty 100

Stock gave a 3 year return of 21.68% as compared to Nifty 100 which gave a return of 33.33%. (as of last trading session)Stock Returns vs Nifty Metal

Stock generated 21.68% return as compared to Nifty Metal which gave investors 46.08% return over 3 year time period. (as of last trading session)

Choose from Peers

Choose from Stocks

- 1D

- 1W

- 1M

- 3M

- 6M

- 1Y

- 5Y

Loading...Insights

Stock Returns vs Nifty 100

Stock gave a 3 year return of 21.68% as compared to Nifty 100 which gave a return of 33.33%. (as of last trading session)Stock Returns vs Nifty Metal

Stock generated 21.68% return as compared to Nifty Metal which gave investors 46.08% return over 3 year time period. (as of last trading session)

See All Parameters

Tata Steel MF Ownership

1,049.58

Amount Invested (in Cr.)

1.64%

% of AUM

0.00

% Change (MoM basis)

727.10

Amount Invested (in Cr.)

1.84%

% of AUM

0.00

% Change (MoM basis)

713.44

Amount Invested (in Cr.)

2.77%

% of AUM

0.00

% Change (MoM basis)

MF Ownership as on 28 February 2025

Tata Steel F&O Quote

- Expiry

Price

159.180.54 (0.34%)

Open Interest

18,00,42,50031,02,500 (1.75%)

Open High Low Prev Close Contracts Traded Turnover (? Lakhs) 160.10 160.18 156.61 158.64 27,956 46,903.73 Open Interest as of 20 Mar 2025

- Type

- Expiry

- Strike Price

Price

1.350.05 (3.85%)

Open Interest

26,95,0002,91,500 (12.13%)

Open High Low Prev Close Contracts Traded Turnover (? Lakhs) 1.65 1.65 0.75 1.30 10,072 17,321.75 Open Interest as of 20 Mar 2025

Tata Steel Corporate Actions

Meeting Date Announced on Purpose Details Feb 14, 2025 Feb 12, 2025 Board Meeting Others Jan 27, 2025 Jan 20, 2025 Board Meeting Quarterly Results & Others Dec 27, 2024 Nov 25, 2024 POM - Nov 06, 2024 Oct 29, 2024 Board Meeting Quarterly Results & Others Jul 31, 2024 Jul 23, 2024 Board Meeting Quarterly Results Type Dividend Dividend per Share Ex-Dividend Date Announced on Final 360% 3.6 Jun 21, 2024 May 29, 2024 Final 360% 3.6 Jun 22, 2023 May 02, 2023 Final 510% 51.0 Jun 15, 2022 May 04, 2022 Final 250% 6.25 Jun 17, 2021 May 05, 2021 Final 100% 2.5 Aug 06, 2020 Jul 07, 2020 All Types Ex-Date Record Date Announced on Details Splits Jul 28, 2022 Jul 29, 2022 May 03, 2022 Split: Old FV10.0| New FV:1.0 Rights Jan 31, 2018 Feb 01, 2018 Dec 20, 2017 Rights ratio: 2 share for every 25 held at a price of Rs 615.0 Rights Jan 31, 2018 Feb 01, 2018 Dec 19, 2017 Rights ratio: 4 share for every 25 held at a price of Rs 510.0 Rights Oct 29, 2007 Nov 05, 2007 Apr 17, 2007 Rights ratio: 1 share for every 5 held at a price of Rs 300.0 Bonus Aug 11, 2004 Aug 12, 2004 Jun 07, 2004 Bonus Ratio: 1 share(s) for every 2 shares held

About Tata Steel

Tata Steel Ltd., incorporated in the year 1907, is a Large Cap company (having a market cap of Rs 1,97,988.81 Crore) operating in Metals - Ferrous sector. Tata Steel Ltd. key Products/Revenue Segments include Steel & Steel Products, Others, Power and Other Operating Revenue for the year ending 31-Mar-2024. Show More

Executives

Auditors

- NC

N Chandrasekaran

Chairman & Non-Exe.DirectorNCN Chandrasekaran

Chairman & Non-Exe.DirectorNCN Chandrasekaran

Chairman & Non-Exe.DirectorNNNoel Naval Tata

Non Executive Vice ChairmanNNNoel Naval Tata

Non Executive Vice ChairmanNNNoel Naval Tata

Non Executive Vice ChairmanShow More - Price Waterhouse & Co Chartered Accountants LLP

Industry

Key Indices Listed on

Nifty 50, BSE Sensex, Nifty 100, + 43 more

Address

Bombay House,24, Homi Mody Street,Fort,Mumbai, Maharashtra - 400001

More Details

Brands

FAQs about Tata Steel share

- 1. What is Tata Steel share price and what are the returns for Tata Steel share?Tata Steel share price is Rs 158.95 as on 20 Mar, 2025, 01:06 PM IST. Tata Steel share price is up by 0.23% based on previous share price of Rs. 154.66. In last 1 Month, Tata Steel share price moved up by 15.15%.

- 2. What is 52 week high/low of Tata Steel share price?Tata Steel share price saw a 52 week high of Rs 184.60 and 52 week low of Rs 122.62.

- 3. Who's the chairman of Tata Steel?N Chandrasekaran is the Chairman & Non-Exe.Director of Tata Steel

- 4. Is Tata Steel giving dividend?An equity Final dividend of Rs 3.6 per share was declared by Tata Steel Ltd. on 29 May 2024. So, company has declared a dividend of 360% on face value of Rs 1 per share. The ex dividend date was 21 Jun 2024.

- 5. What is the CAGR of Tata Steel?The CAGR of Tata Steel is 10.01.

- 6. What is the market cap of Tata Steel?Within the Metals - Ferrous sector, Tata Steel stock has a market cap rank of 2. Tata Steel has a market cap of Rs 1,97,951 Cr.

- 7. Who are the key owners of Tata Steel stock?Following are the key changes to Tata Steel shareholding:

- Promoter holding has not changed in last 9 months and holds 33.19 stake as on 31 Dec 2024

- Domestic Institutional Investors holding have gone down from 23.45 (31 Mar 2024) to 23.38 (31 Dec 2024)

- Foreign Institutional Investors holding have gone down from 19.61 (31 Mar 2024) to 18.53 (31 Dec 2024)

- Other investor holding has gone up from 23.75 (31 Mar 2024) to 24.9 (31 Dec 2024)

- 8. Who are peers to compare Tata Steel share price?Within Metals - Ferrous sector Tata Steel, JSW Steel Ltd., Jindal Steel & Power Ltd., Steel Authority of India (SAIL) Ltd., Shyam Metalics and Energy Ltd., Technocraft Industries (India) Ltd., Prakash Industries Ltd., Steel Exchange India Ltd., Visa Steel Ltd., Manaksia Steels Ltd. and Incredible Industries Ltd. are usually compared together by investors for analysis.

- 9. Who is the CEO of Tata Steel?T V Narendran is the Managing Director & CEO of Tata Steel

- 10. What are the returns for Tata Steel share?Return Performance of Tata Steel Shares:

- 1 Week: Tata Steel share price moved up by 5.35%

- 1 Month: Tata Steel share price moved up by 15.15%

- 3 Month: Tata Steel share price moved up by 12.99%

- 6 Month: Tata Steel share price moved up by 4.56%

- 11. What are the Tata Steel quarterly results?Total Revenue and Earning for Tata Steel for the year ending 2024-03-31 was Rs 230979.63 Cr and Rs -4437.44 Cr on Consolidated basis. Last Quarter 2024-12-31, Tata Steel reported an income of Rs 53869.33 Cr and profit of Rs 326.64 Cr.

- 12. What are the key metrics to analyse Tata Steel Share Price?Tata Steel share can be quickly analyzed on following metrics:

- Stock's PE is 72.64

- Price to Book Ratio of 2.14

- 13. What is the PE & PB ratio of Tata Steel?The PE ratio of Tata Steel stands at 72.49, while the PB ratio is 2.14.

Trending in Markets

Top Gainers As on 01:06 PM | 20 Mar 2025

Top Losers As on 01:09 PM | 20 Mar 2025

Tata Steel Quick Links

Equity Quick Links

More from Markets

IPOStock market news

Budget 2022 Live Updates

Cryptocurrency

Currency converter

NSE holiday list

DATA SOURCES: TickerPlant (for live BSE/NSE quotes service) and Dion Global Solutions Ltd. (for corporate data, historical price & volume, F&O data). Sensex & BSE Quotes and Nifty & NSE Quotes are real-time and licensed from BSE and NSE respectively. All timestamps are reflected in IST (Indian Standard Time).

DISCLAIMER: Any and all content on this website including tools/analysis is provided to you only for convenience and on an “as-is, as- available” basis without representation and warranties of any kind. The content and any output of such tools/analysis is for informational purposes only and should not be relied upon or construed as an investment advice or guarantee for any specific performance/returns advice or considered as recommendation for the purchase or sale of any security or investment. You are advised to exercise caution, discretion and independent judgment with regards to the same and seek advice from professionals and certified experts before taking any decisions.

By using this site, you agree to the Terms of Service and Privacy Policy.